"PatBateman" (PatBateman)

"PatBateman" (PatBateman)

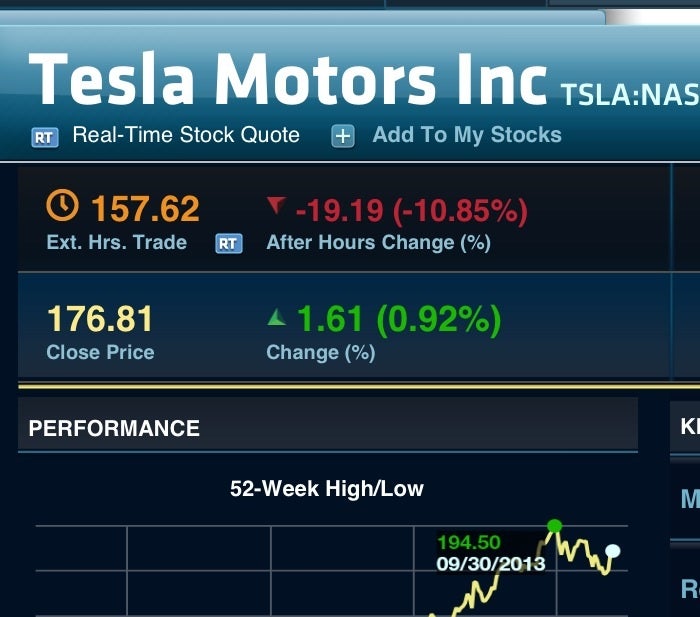

11/05/2013 at 16:25 • Filed to: $TSLA

0

0

17

17

"PatBateman" (PatBateman)

"PatBateman" (PatBateman)

11/05/2013 at 16:25 • Filed to: $TSLA |  0 0

|  17 17 |

Can't give any advice on this (or any other) stock, and no one knows what it will do tomorrow during regular trading hours, or in the future, but always talk to a financial advisor before making investment decisions.

That is all.

vdub_nut: scooter snob

> PatBateman

vdub_nut: scooter snob

> PatBateman

11/05/2013 at 16:31 |

|

BUY BUY BUY IT'S BOTTOMED OUT

PatBateman

> vdub_nut: scooter snob

PatBateman

> vdub_nut: scooter snob

11/05/2013 at 16:33 |

|

Kramer, I've told you three times already... STOP IT.

Decay buys too many beaters

> PatBateman

Decay buys too many beaters

> PatBateman

11/05/2013 at 16:34 |

|

Jesus, did they have another fire or something? As much as I wish I'd sold around the $200/share mark, I'm still convinced it will climb to a higher point once the model X is released. We will not see the true fair market value of TSLA for the next few years, or until they finally release a car that competes directly in the compact sector.

Either way, I bought a couple of shares really early on so I'll be holding on to them.

davedave1111

> PatBateman

davedave1111

> PatBateman

11/05/2013 at 16:36 |

|

always talk to a financial advisor before making investment decisions.

Yes, it's good to have a laugh before you get down to work :)

ddavidn

> PatBateman

ddavidn

> PatBateman

11/05/2013 at 16:37 |

|

I still can't afford a share. But I am keeping tabs on it as if I had several.

IDROVEAPICKUPTRUCK

> PatBateman

IDROVEAPICKUPTRUCK

> PatBateman

11/05/2013 at 16:38 |

|

I had been thinking about shorting Tesla for a while, guess I might have missed my chance. Tesla is an awesome company but their stock prices bears no relation to reality.

Bob Loblaw Made Me Make a Phoney Phone Call to Edward Rooney

> PatBateman

Bob Loblaw Made Me Make a Phoney Phone Call to Edward Rooney

> PatBateman

11/05/2013 at 16:40 |

|

And this, class, is why we don't participate in the trading of firms whose "value" (I used that word so very loosely, here) is derived entirely from technical analysis without any basis in fundamental analysis. Anyone taking it in the shorts over this deserves it, and I'd like to see the slide continue into regular trading hours.

But that would represent an appropriate correction, and I don't see that coming.

PatBateman

> davedave1111

PatBateman

> davedave1111

11/05/2013 at 16:55 |

|

Yes, because investing is as simple as opening an E-Trade account and reading some blogs on the Internet. I mean, it has to be!! The ETRADE baby said so!!

All I have to say is that if you think that reading some Internet blogs makes you a better investor than someone with years of experience, formal investment education, multiple securities licenses/designations, and a small army of analysts with positive track records, you're high.

PatBateman

> Decay buys too many beaters

PatBateman

> Decay buys too many beaters

11/05/2013 at 16:57 |

|

How are you calculating this stock's "true fair market value"? And is the P/E ratio any part of that?

Textured Soy Protein

> PatBateman

Textured Soy Protein

> PatBateman

11/05/2013 at 17:01 |

|

My investment strategy: wait for stocks that have a good long-term future to temporarily tank, then scoop them up at a discount.

Worked for me on FB...maybe I'll take a flyer on some TSLA.

PatBateman

> Textured Soy Protein

PatBateman

> Textured Soy Protein

11/05/2013 at 17:04 |

|

I'll tell you what I've told other people on this site: while I cannot give investment advice on the Internet, I urge you to call up your local branches of Morgan Stanley, Merrill Lynch, and UBS, ask to speak to an advisor, and ask them what their company's target price (price objective) of the stock is. They employ thousands of analysts and pay them hundreds of thousands of dollars EACH.

davedave1111

> PatBateman

davedave1111

> PatBateman

11/05/2013 at 17:07 |

|

Eh? Where did all that come from? Are you honestly telling me you've never heard that joke before? You remind me of another oldy:

A guy in a bar leans over to the guy next to him and says, "Want to hear a financial adviser joke?" The guy next to him replies, "Well, before you tell that joke, you should know that I'm 6 feet tall, 200 pounds, and I'm a financial adviser. The guy sitting next to me is 6'2" tall, 225 pounds, and he's a financial adviser. And the guy sitting next to him is 6'5" tall, 250 pounds, and he's a financial adviser. Now, do you still want to tell that joke?" The first guy says, "No, I don't want to have to explain it three times."

PatBateman

> davedave1111

PatBateman

> davedave1111

11/05/2013 at 17:16 |

|

A yes... The old [enter whatever occupation you're making fun of here] bar joke. Absolutely HILLARIOUS.

You know what I laugh at? People that declare how it's so easy to make money in a bull market, and then go broke in a bear market. I had plenty of good chuckles when the dust settled in 2009.

Decay buys too many beaters

> PatBateman

Decay buys too many beaters

> PatBateman

11/05/2013 at 17:16 |

|

I'm mostly commenting that the stock right now is pretty unstable and primarily owned by short traders. There are about 13 million shares of Tesla bought/sold every day out of 120 million shares (of which Musk owns 25%). So the remaining 75% has about a 15% daily turnover rate.

That's quite a lot compared to say Google at 0.6% daily turnover rate. And Apple with a 1.2% daily turnover rate.

PatBateman

> Decay buys too many beaters

PatBateman

> Decay buys too many beaters

11/05/2013 at 17:29 |

|

Turn over rates aren't usually considered when an analyst calculates what a stock is worth. You could compare the P/E ratios of similar companies...

davedave1111

> PatBateman

davedave1111

> PatBateman

11/05/2013 at 17:51 |

|

Yeah, it's an oldie, like I said. To go with your old chestnut that I responded to initially with the punchline. Still not sure what rubbed you up the wrong way.

You know what I laugh at? People that declare how it's so easy to make money in a bull market, and then go broke in a bear market.

Maybe it's being lost in translation, but what you're describing there is what we in the UK call a financial advisor. People who are actually competent to give investment advice are not called FAs.

I thought it was the same in the US, though. Investment banks don't employ FAs except as salesmen, do they?

Decay buys too many beaters

> PatBateman

Decay buys too many beaters

> PatBateman

11/05/2013 at 18:04 |

|

Hmm, it appears I still have a lot to learn. I'll be honest here, I purchased Tesla stock back in 2010 because I thought the roadster was "cool".

But most financial publications and even Musk himself, admit that the stock is currently overvalued.